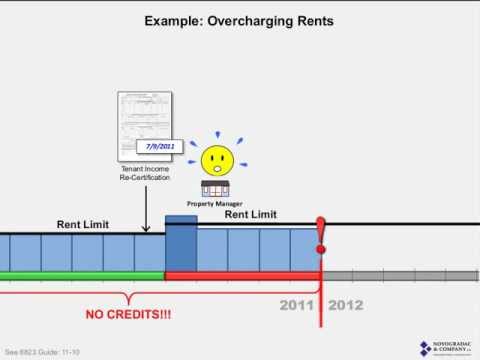

We have a tenant here. They've been living in our project for a while. - They come up for recertification. - New income limits had come out and we say, "Oh, you're up for recertification. Let's up you to the new rent limit." - So we up them, but when we do it, we actually up them too far. - We put them over the limit, but then we quickly say, "Oh no, we put them over the limit." - So in the next month, we're a little concerned. - We put them even further below the limit. - The IRS has said in the 88 23 guide that if you're out of compliance with the rent limit for one month, you lose credits for the entire year. - Which is a pretty strict answer. - They even said you can't just rebate the rent to the tenant to be back in compliance. - You're out of compliance for that full year. - Now, this is a pretty strict answer and I understand why the IRS publishes this answer because they don't want property owners to go out there and rent units at market rate. - And then when the state agency comes out and finds them, they say, "Oh, oh, whoops, we're running a market rate. I didn't know that. Let me go refund all this rent to the tenants and then I'll be back in compliance." - The IRS doesn't like that, so they're taking a very strict stance in the 88 23 guide. - But it's always been my opinion that if you overcharge your rent, you have two options. - You can say, "Oh well, I overcharged. I'm going to do nothing. I'll probably have non-compliance. I'm going to lose credits." - Or you can say,...

Award-winning PDF software

Irs 8823 handbook Form: What You Should Know

Income Limitations for the Low-Income Housing Credit — IRS Mar 27, 2025 — Effective November 1, 1995 (the tax year ending September 30, 1997) a taxpayer with total income under 20,000 (16,000 if married filing jointly) could not claim the low-income housing credit in that year. In 2015, that reduced to 1,000. The IRS issued final regulations in April 2025 reducing that lower income limit for the low-income housing credit to 2,000 for a married/civil union taxpayer with a child under 13.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8823, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8823 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8823 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8823 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs 8823 handbook